Which Entity Should I Form When Starting a New Business?

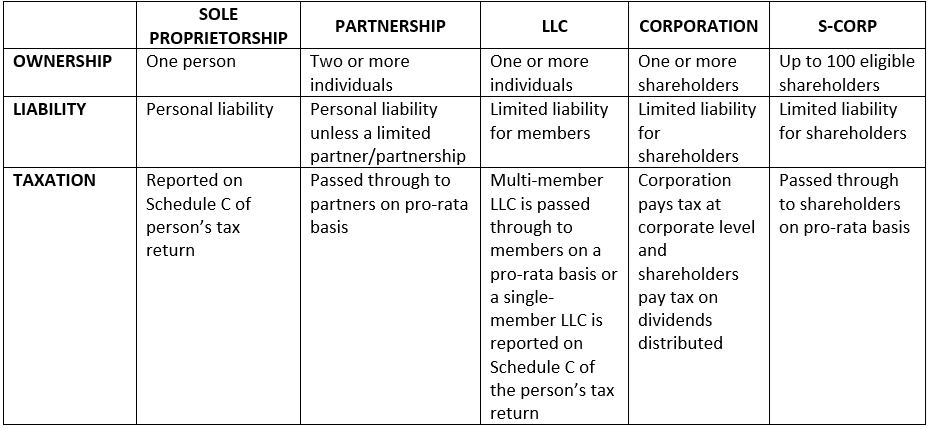

Client AlertAs a tax law attorney, friends and acquaintances ask me this question all the time: what type of entity should I form when starting a new business? With many business options available it can be confusing determining which business structure would be appropriate. Below is a general overview of each business structure and the tax responsibilities of each.

Sole Proprietorship

A sole proprietorship is a person who operates a business but has not registered the business with the applicable state’s Secretary of State. In other words, it is not a legal entity. A sole proprietorship is also owned by one person who bears all the liability of the business. This means the owner is personally responsible for all the business’s debt.

All income and expenses of a sole proprietorship are reported directly on Schedule C of the owner’s personal tax return. The owner will pay both the employer and employee’s portion of self-employment (FICA) taxes associated with the net income from the business on his/her personal tax return.

Partnership

A partnership is a relationship between two or more people to operate a business. Generally, each partner contributes money, skills, property, or labor and then shares in the profit and losses of the business. While it is good business practice for a partnership to have a formal written partnership agreement, it is not required. In addition, each state has its own rules on whether a partnership must register with the state’s Secretary of State.

Partners are able to bind the partnership to a contract as long as the act is within the scope of the partnership’s business. Partners may also be liable for the partnership’s debt depending on the type of partnership.

There are three types of partnerships to choose from: general, limited, and limited liability.

- A general partnership means all the partners participate in the day-to-day business operations. General partners have personal liability for the business’s debt.

- Limited partnerships have a combination of general partners and limited partners. The limited partners do not participate in the day-to-day business operations and do not have personal liability for the business’s debts. The general partners participate in the day-to-day business operations and have personal liability for the business’s debt.

- Limited liability partnerships provide liability protection for all partners, whether general or limited partners. Generally, limited liability partnerships are formed by accountants and lawyers.

Partnerships must file a tax return with the IRS each year. The partnership’s tax return will report all the business’s income, deductions, gains, and losses for the year. The partnership does not pay taxes on the partnership’s income, but instead it is “passed through” to the partners. The partnership return will issue a Schedule K-1 to each partner reporting each partner’s share on income and losses. Each partner will then report the respective income and losses on his/her personal tax return.

Limited Liability Company

By far, the most popular business to form is the limited liability company or LLC. A limited liability company is determined by the individual states. Each state has different regulations – see one recent change to Ohio’s LLC regulations, here. However, in general, LLCs can have one or more owners. The owners are called members and there is no maximum number of individuals who can be members.

Limited liability members enjoy the benefits of limited liability, which means the members have no personal liability for the business’s debts. An LLC does not have many regulations, and members have flexibility in how the business is structured and run. Like partnerships, LLCs should have a formal Operating Agreement and some states require such an agreement.

The IRS does not recognize an LLC for federal income tax purposes. Therefore, how an LLC is taxed each year depends on several factors. The first factor is whether the LLC is a single-member LLC or a multi-member LLC.

A single-member LLC is considered a disregarded entity with the IRS. This means that, similar to a sole proprietor, the single member will report the LLC’s income and expenses directly on Schedule C of his/her personal tax ret

A multi-member LLC may be taxed one of two ways. If no additional filings are made with the IRS, a multi-member LLC is considered a partnership with the IRS and will be taxed as a partnership. The LLC may also choose to elect to be taxed as an S-corporation. In order to be taxed as an S-corporation, the LLC must file Form 8832 with the IRS and affirmatively elect to be treated as a corporation. Under either a partnership or S-corporation taxation, the LLC’s income and expenses are passed through to each member. Each member will be issued a Schedule K-1 and must then report his/her share of the LLC’s income and expenses on his/her personal tax return.

Corporation

A corporation is a business structure that is separate and apart from its owners. Because a corporation is a separate entity, the owners are generally shielded from the corporation’s liabilities. A corporation consists of shareholders, a board of directors, and officers. Individuals purchase stock in the company, becoming a shareholder. The shareholder then legally owns the assets of the business. Shareholders do not generally run the business on a day-to-day basis. Shareholders elect a board of directors who appoint officers. The officers are tasked with running the day-to-day operations of the corporation.

Corporations have certain formalities that must be followed. Some of these formalities are annual meetings, maintaining corporate minutes, maintaining all written agreements for all transactions, maintaining separate bank accounts, and following the corporation’s bylaws.

A corporation must file a tax return each year with the IRS. A corporation is recognized as a separate taxpaying entity and is taxed on the corporation’s profits. As a separate taxpaying entity, double taxation may occur. Currently, corporations are taxed at a flat rate of 21%, however, this is subject to change. When a corporation distributes dividends to shareholders, the shareholder must report and pay tax on the dividends on his/her individual tax return. No tax deduction occurs for the corporation when dividends are distributed.

S-Corporation

S-corporation, or S-corp, is not an entity that is formed with a state’s Secretary of State. Instead, an S-corp is a tax designation. In order to be taxed as a S-corp, the company must file an election with the IRS affirmatively elected such tax treatment. In addition, an S-corporation has certain requirements that must be met to qualify as an S-corp. These requirements are:

- Be a domestic corporation

- Have only individuals, certain trusts and estates, and single-member limited liability companies as shareholders

- Partnerships, multi-member limited liability companies, corporations and non-resident aliens are not permitted to be shareholders.

- Have no more than 100 shareholders

- Have only 1 class of stock

- Not be an ineligible corporation (certain financial institutions, insurance companies, and domestic international sales corporations)

S-corps are also required to follow the same corporate formalities of a C-corporation while also paying a reasonable wage to any shareholder that participates in managing the company.

An S-corp is required to file a tax return with the IRS each year. The S-corp’s tax return will report all the business’s income, deductions, gains, and losses for the year. In general, the S-corp does not pay taxes on the partnership’s income, but instead it is passed through to the shareholders through a Schedule K-1.

For additional questions related to entity formation and the taxation of various entities, please contact BMD Tax Law Attorney Tracy Albanese at tlalbanese@bmdllc.com or (330) 253-9195.